11 July 2024

Your GSK Pension and climate change – 2023 update

You can also read the full TCFD report.

Why climate change matters for your GSK pension

We, as Trustees of the GSK pension plans, make decisions about how and where to invest your retirement savings. These investments are potentially impacted by climate change.

Pension schemes can play a crucial role in managing climate change by considering these risks when investing. That’s why, each year, pension schemes are required to publish a climate-related report setting out the approach to managing and monitoring these risks. There will also be some positive investment opportunities from moving to a low-carbon economy, through investing in companies who are better prepared to manage these risks.

What we’re doing about climate change

We recognise climate change as one of the most important issues of our time. Our annual climate report includes assessing the impact of these risks on pension investments and developing a plan to mitigate these.

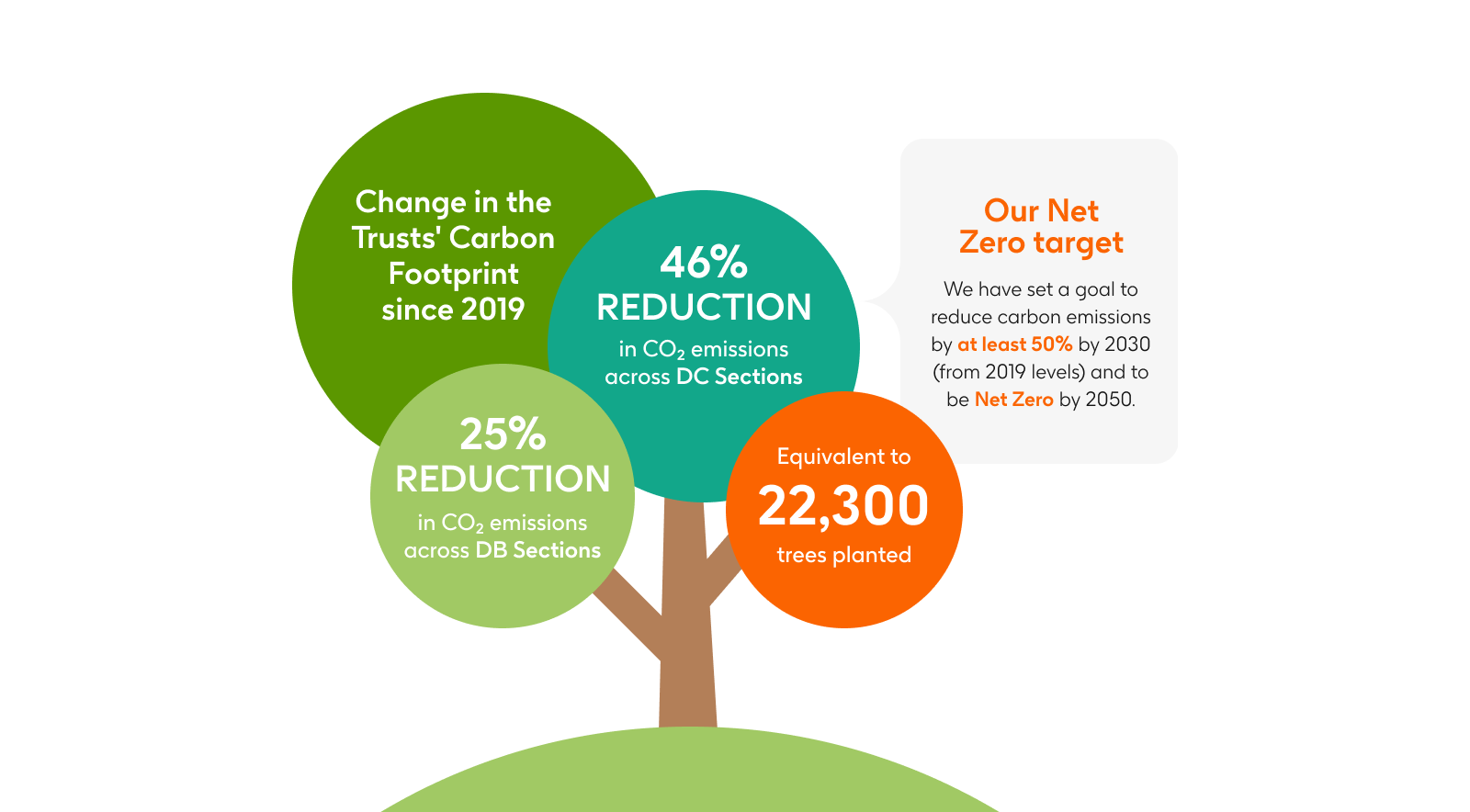

We have set the following target:

"The Trustees commit to the aims of the Paris Agreement, expecting to reduce carbon emissions associated with its portfolio by at least 50% (from 2019 levels) by 2030 and to reduce carbon emissions to ‘net zero’ by 2050."

We track progress against the target, by primarily looking at the estimated carbon footprint of investments, which is used as a measure of the Plans’ investments in emissions-intensive companies.

How are we doing against our targets?

We are pleased to have made significant progress towards our target, with our carbon footprint reducing since 2019 by 25% for the Defined Benefit (DB) Sections, and 46% for the Defined Contribution (DC) Sections.

That’s equivalent to removing over 29,000 cars from the road or planting over 22,000 trees.

What about ESG?

Alongside an increased emphasis on climate-related considerations, we also recognise the importance of other ESG (Environmental, Social, Governance) factors as well as the importance of sustainability in a broader sense. This view is also reflected in the management of the Plans’ investments.

FAQs

What is climate change?

What is climate change?

What are the risks of climate change?

What are the risks of climate change?

How does the 2023 report compare to last year?

How does the 2023 report compare to last year?

What is ESG integration?

What is ESG integration?

How is ESG incorporated?

How is ESG incorporated?

Where’s the full report?

Where’s the full report?

More information?

More information?

Notes

"GSK Plans" refer to GSK Pension Scheme, GSK Pension Fund, Glaxo Wellcome Contracted-Out Money Purchase Scheme and SmithKline Beecham Pension Plan.

1Carbon footprint is an intensity measure of emissions that assesses the level of greenhouse gas emissions arising from a $1 million investment in a fund.